Travel isn’t just about exploring new horizons and creating memories; it’s also about handling the unexpected with confidence.

Imagine being stranded in a foreign country due to a sudden airline strike or facing emergency surgery in a place where your health card doesn’t work. These scenarios are not just hypotheticals—they happen more often than you might think. For instance, according to a survey by Which?, 28% of travel insurance claims are for medical costs, and 27% are due to cancellations.

Whether it’s medical emergencies, theft, or trip cancellations, having travel insurance can safeguard your travels from unforeseen financial strains.

In this post, we discuss why travel insurance should be a staple in your travel planning based on our extensive travel experiences since 2017.

If You’re in a Hurry: Key Takeaways on Travel Insurance

Why You Need Travel Insurance

- Travel insurance is crucial for managing unexpected events like medical emergencies, theft, and trip cancellations.

- Our experiences underscore its importance, such as dealing with chest pains in Portugal and having bikes stolen in Rotterdam.

Our Top Travel Insurance Tips

- Understand Your Policy: Know the specifics of what your travel insurance covers, including exclusions and limitations.

- Extreme Sports Coverage: If you’re into adventure sports, ensure activities like whitewater rafting or bungee jumping are included.

- Geographical Restrictions: Verify if your travel insurance covers all your destinations, especially those under travel advisories.

- Personal Belongings: Confirm if high-value items like electronics are covered or if you need additional insurance.

- Routine Medicals: Be aware that most policies don’t cover routine medical checkups.

- Car Rental Excess: Check if car rental excess fees are included in your coverage.

- Know Your Policy: Familiarize yourself with claim requirements and conditions to avoid issues during emergencies.

- Document Everything: Keep all relevant paperwork, receipts, and documents organized for easy access when making claims.

- Digital Backup: Scan important documents and store them securely online for access anywhere.

- Contact Information: Have the contact details of your insurance provider handy, including phone numbers and policy numbers.

- Timely Reporting: Report any incidents to your insurance provider as soon as possible to prevent complications with claims.

For detailed information and personal anecdotes, keep reading!

Why Travel Insurance is Essential for Every Traveller

Our journey with travel insurance has taught us its critical role. Whether it was dealing with medical emergencies like sudden chest pains while road-tripping in Portugal or replacing stolen bikes in Rotterdam, our coverage has allowed us to focus on recovery and enjoyment rather than financial stress.

When I had chest pains, the doctor thought I was having a heart attack, and I was rushed to hospital. Luckily, it wasn’t a heart attack—but the costs of the ambulance, numerous hospital tests, and scans soon mounted up.

There is every possibility that I might well have gone into cardiac arrest at the sight of the bill if I hadn’t known our travel insurance would cover the costs!

Personal Experiences with Travel Insurance

We don’t want to think about worst-case scenarios. When you are travelling, however, knowing that those unthinkable possibilities are covered by insurance means you can enjoy your journey so much more without niggling worries going on in the background.

Travel insurance isn’t cheap, but neither are hospital bills in another country, which can soon ramp to thousands of dollars, depending on the extent of the injury. We all want to travel cheaply, but cutting out travel insurance isn’t a good move.

We’ve had to use our travel insurance on several occasions, demonstrating its importance in various situations:

- Medical: Those chest pains in Portugal

- Medical: Lars tore his knee tendons when we were house-sitting in France

- Theft: Stolen bikes in Rotterdam

- Car Damage: Covering the insurance excess on our hired motorhome for damage and best of all

- Theft: Most of our clothes were stolen when our 4×4 was broken into in Namibia.

- Camera Damage: Claiming on our photographic insurance when a parrot swallowed Lars’ shutter button on his new camera.

Luckily, we caught the sneaky thief on camera, so there was plenty of proof for our seemingly bizarre claim.

Check out this hilarious moment when a parrot decided to take a bite out of Lars’ camera by eating the shutter button, all the while sweet talking Lars into staying still. Watch the video below to see the feathered culprit in action!

Understanding Your Coverage: What to Look For

Initially, we chose SafetyWing for its budget-friendly rates, ease of use, and comprehensive medical coverage. However, as we’re both now over 55, we’ve transitioned to World Nomads due to age-related pricing and the need for more extensive coverage.

💡 Grab a quote from World Nomads today

Knowing what your travel insurance covers is crucial. From medical expenses and evacuation to theft and trip cancellations, understanding the specifics can help you choose the right policy. Here are a few things to consider:

- Extreme sports coverage: If you’re an adventure seeker, ensure activities like whitewater rafting or bungee jumping are covered.

- Geographical restrictions: Some policies exclude countries under travel advisories or embargoes.

- Personal belongings: Check if high-value items like electronics are covered or if additional coverage is necessary. Check if the policy covers accidental damage or theft of personal belongings.

- Routine Medicals: Most Insurance policies don’t cover routine medical checkups.

- Car Rental Excess: Are car rental excess fees covered?

For a deeper dive into the realities of travel insurance claims, Which? recently revealed the most common reasons travellers file claims.

Their survey of over 800 policyholders highlights key areas such as medical costs, cancellations, and delays, which underscore the importance of selecting the right coverage for your needs. They found that 28% of claims were related to medical costs, while 27% were due to cancellations.

🔎 More Important Travel Tips: If you plan on travelling as a couple, check out our post on: How to Travel With Your Partner and Stay Sane! 😂

Why We Topped up Our Travel Insurance

I need to explain why we took out additional Garmin evacuation insurance. This insurance covers evacuation for any reason.

We considered this a necessary addition because we were overlanding throughout Southern Africa, namely, South Africa, Botswana and Namibia and often in remote areas.

Worry no more. The Garmin InReach Mini has you covered.

Signing up for the satellite communication subscription automatically includes SOS coverage, providing global 24/7 monitoring and dispatch when SOS on the device is activated.

The Garmin InReach Mini device is reliable because it uses the Iridium satellite system, which provides 100% global network coverage. Once the Garmin device distress signal (SOS button) is triggered, the Garmin 24-hour emergency coordination centre communicates with you to provide the appropriate evacuation service.

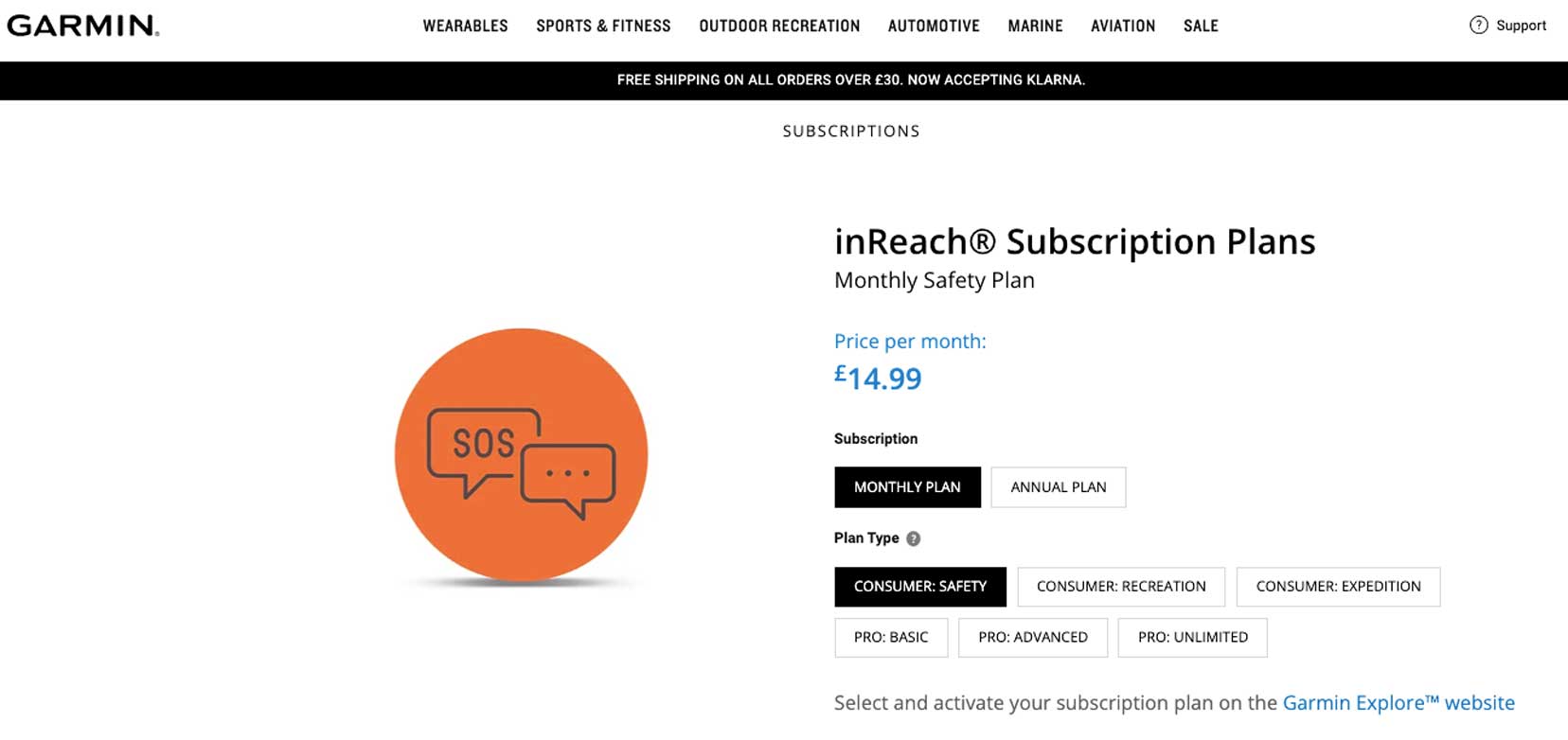

The basic Garmin coverage does not include costs incurred following an SOS activation. However, this can be added. This is exactly what we have done. Garmin offers differently priced plans for both light and heavy network users – take a look at the different Garmin plans here.

So, in the end, we chose the Garmin Freedom Safety Plan at £14.99 per month + an annual subscription fee of £34.99 and added the SAR 100 Search and Rescue Insurance Plan (USD$43 annual fee).

When evacuation costs can run into thousands of dollars, having Garmin insurance really gives us peace of mind.

Keeping Your Paperwork in Order

Whatever travel insurance you choose, make sure you read the fine print of your policy.

- Know Your Policy: Understand the claim requirements and conditions. Keep notes handy to ensure you can meet these requirements during an emergency or when filing a claim.

- Document Everything: Keep all relevant paperwork, receipts, and documents organized. This ensures you have the necessary evidence to support your claim.

- Digital Backup: Create a digital backup of your documents. Scan important papers and store them securely online for easy access from anywhere in the world.

- Contact Information: Always have the contact details of your insurance provider easily accessible. This includes phone numbers, email addresses, and policy numbers.

- Timely Reporting: Report any incidents to your insurance provider as soon as possible. Delays can sometimes complicate the claims process or result in denial.

Pro Tip: Create a travel folder that includes copies of your travel insurance policy, emergency contact numbers, and important medical information. This folder can be physical or digital, on your phone or cloud storage.

Why You Need Travel Insurance … That’s a Wrap

Travel insurance is more than just an added expense; it’s a crucial safety net that ensures you can handle unexpected challenges with confidence. From medical emergencies and theft to trip cancellations, the right coverage can alleviate financial stress and allow you to focus on enjoying your travels.

Reflecting on our experiences since 2017, we have found that comprehensive travel insurance is essential. Whether you’re a seasoned traveller or planning your first big trip, understanding your policy and choosing the right coverage can make all the difference.

Stay safe and travel smart with the peace of mind that travel insurance provides.

✅ Click here for an instant SafetyWing quote.

OR

✅ Here for a quote from World Nomads.

We never travel without travel insurance because we believe it’s a vital part of travel. We hope this information is useful for you when considering your travel insurance requirements.

Happy and safe travels

Shelley and Lars

Read More :

World Nomads provides travel insurance for travellers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Pin on Pinterest

Planning Your Travels?

These are the travel resources we recommend and use when planning our trips.

- 🚘 Car Hire: We use DiscoverCars.com

- Motorhome/Campervan Rental: We highly recommend the Motorhome Republic

- 🪪 Order your International Driver’s Licence online here

- ✈️ Flights: Find flights on Skyscanner

- 🛏 Book Accommodation: We use Booking.com to find accommodation that suits our budget

- 🐶 Pet Sitting/Pet Sitters: Check Out TrustedHousesitters here (Use our Discount code: LIFEJOURNEY25 for 25% off. )

- Activities and Experiences: Get Your Guide and Viator

- Travel Insurance: Safetywing or World Nomads

- 🥾 Travel Gear and Accessories: Check out our top picks here — Lifejourney4two page on Amazon

For a more thorough list, visit our Travel Resources page here.